Most markets around the world have gradually improved the environment for fund investors through greater investment transparency over the past few years—a development that has been guided by better disclosure practices, including portfolio holdings disclosure. Transparency is important as it helps investors make better decisions and creates trust in investment vehicles and the firms that manage client assets.

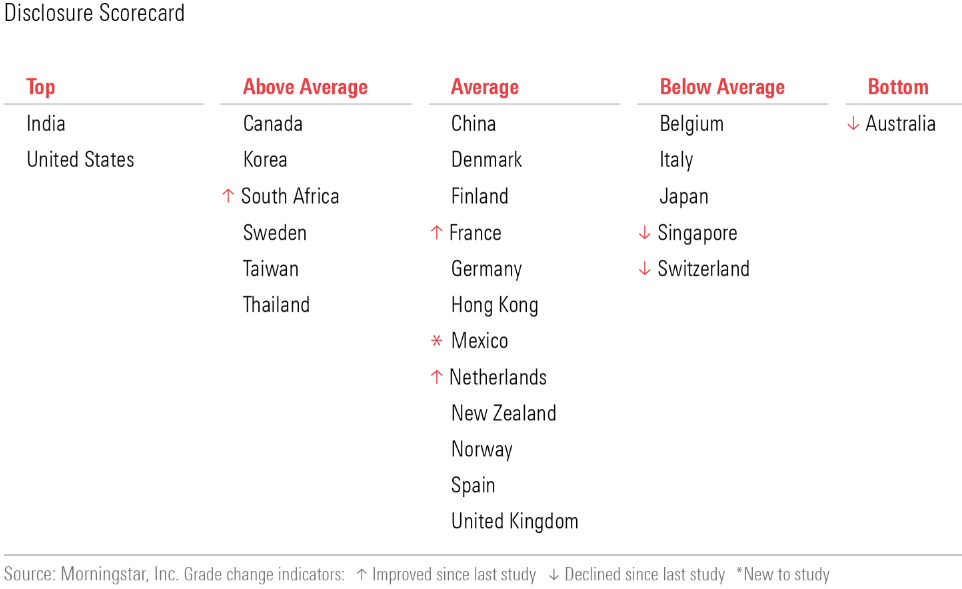

This trend toward greater investment transparency was one of the top findings from the Disclosure chapter of Morningstar's 2020 Global Investor Experience study, which evaluates the environment for fund investors in markets around the world. As shown below, the highest overall Disclosure grades went to India and the United States, while the lowest went to Australia.

Here, we detail the market characteristics that drive greater investment transparency for retail investors. Here are some of the central findings.

4 Key Takeaways From Morningstar's 2020 Global Investor Experience Study: Disclosure

1. The United Kingdom set a new global standard in the area of Fee Disclosure with its Assessment of Value Report, which requires fund firms to regularly assess and publicly disclose the reasonableness of their fees. This key development from the Financial Conduct Authority, which took effect in September 2019, requires fund groups to assess the overall value that their funds deliver to investors and provide their findings in an annually published summary report. The Assessment of Value report covers seven areas, including fees, performance, economies of scale, and differences between share classes. UK fund investors stand to benefit not only from this report's increased disclosure but also from the associated impetus for fee reductions on select funds.

2. ESG and Stewardship Disclosure is an important emerging area, and regulators should prioritise more standardised disclosure in this area to inform fund investors' understanding and comparison of products.

Best practice is for a market to have ESG-relevant regulation and a stewardship code that requires the disclosure of information to support a fund's claimed green credentials and stewardship activities. Worldwide, much regulation is in the pipeline to provide more standardised disclosure. This ought to help prevent greenwashing—that is, using ESG claims in fund marketing without ESG principles truly guiding investment decisions—from being a significant issue for fund investors.

Europe has been the most assertive in this area, with Sweden the leader in ESG disclosure standards because of its specific requirements. Outside of Europe, the Hong Kong regulator’s website discloses a list of green funds—an example of a simple yet impactful initiative that helps investors more easily identify funds that meet stated ESG requirements. The US lags in this area, with no specific ESG labelling requirements or standards set by the government or related bodies.

3. Regulators continue to demand complete and increasingly timely portfolio holdings disclosure—except in Australia.

Fund investors are entitled to know how their money is being invested. If investors want to avoid exposure to fossil fuels, for example, they need portfolio holdings data (which names the stocks or bonds a fund holds) to provide that transparency. Ideally, complete portfolio holdings are publicly available from a central website, such as an industry association or a regulator.

Pleasingly, nine markets in this study follow this practice, while 12 other markets have portfolio holdings data available on the asset managers' websites. Australia, meanwhile, stands alone with the weakest disclosure regime of the 26 markets evaluated in this study. An otherwise sophisticated market,

Australia is the only one where portfolio holdings disclosure is not required.

In contrast, Mexico and India set the bar for monthly disclosure of full portfolio holdings . Mexico is the only market in this study that requires weekly portfolio disclosure of material positions. And, Indian regulations were updated in October 2020 to mandate that fixed-income funds disclose full portfolio holdings via a downloadable Excel spreadsheet within five days of each fortnight—an important step in ensuring the data available to investors is accessible and up to date.

4. Investors should know who manages their money and how these individuals are compensated.

This issue aligns with an increasing focus on governance practices. We find it inequitable that fund investors are not provided with information about the individuals managing their money on an equivalent basis to the information that is available about the individuals at the helms of the public and private companies in which fund managers invest.

Investors need to know portfolio managers' names and when their tenures began in order to know who is responsible for a fund's strategy and performance during different periods and also to know if the managers at a fund are changing frequently or are in place for the long haul.

Only 12 markets in this study require that the name and tenure of at least the lead portfolio manager be included in fund literature, and only six require disclosure of manager compensation structures. India goes the furthest in this regard; it is now the only market in the survey requiring funds to disclose managers' actual amounts of compensation. Along with India, the US features global best practices for the disclosure of portfolio manager names, fund ownership, and compensation.

Disclosure is the third and final chapter in the 2020 Global Investor Experience Study. Previous chapters focus on Fees and Expenses and Regulation and Taxation.