Stock investing in 2020 has been tumultuous, to say the least. The market hit new highs early in the year, was derailed by the Covid-19 worries, and then rebounded with head-spinning speed.

The persistence of the coronavirus pandemic, economic uncertainty, and an upcoming US election will likely keep stock investors on their toes for the foreseeable future.

What’s the prescription for successful stock-picking during times of turmoil? At Morningstar, we think the keys are focusing on the fundamentals and investing for the long term.

We asked a team of Morningstar’s senior equity analysts to identify a handful of investment themes they expect to dominate during the next decade.

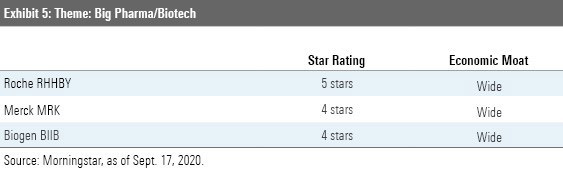

Theme #1: Cannabis

Cannabis stocks have been on a rollercoaster the past few years, acknowledges sector director Kris Inton. We nevertheless expect to see a good deal of change in cannabis consumption in the coming decade, which will drive growth. Right now, the legal US market is estimated at more than $10 billion. By 2030, we forecast that figure to balloon to more than $80 billion, he reports.

Where will that growth come from? More states will likely legalise tetrahydrocannabinol, or THC, cannabis - and the pandemic may only accelerate that, as states look for new tax dollars to plug budget gaps, says Inton. We also think users from the black market will migrate to the regulated, legal market, and that some non-users may become consumers upon legality. “The legal market is set for massive growth benefiting all cannabis producers,” concludes Inton.

Several of the cannabis producers we cover are undervalued today.

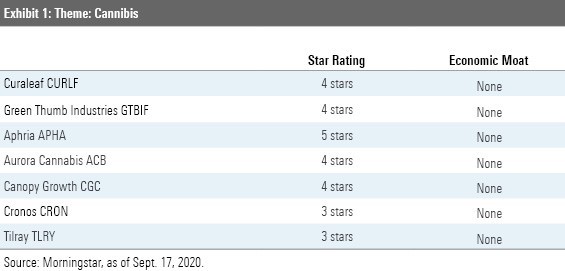

Theme #2: 5G

“We view 5G as more evolutionary than revolutionary for wireless carriers,” asserts sector director Mike Hodel. We expect wireless carriers to continue to invest in their networks to keep up with customer demand and improve service.

We think that the firms that stand to benefit most from 5G are those that can leverage the technology to drive innovation, such as application developers or media firms. It’s tough to identify these companies in advance, admits Hodel, because so many will likely come in the form of startups.

That being said, companies that facilitate 5G-related services stand to benefit, too including semiconductor firms like Skyworks (SWKS), Qualcomm (QCOM), and Qorvo (QRVO), and equipment vendors such as Nokia (NOK). Dish Network (DISH) might be of interest as a more speculative play, says Hodel, as it plans to build out a new wireless network. And for those seeking a pick among mainstream carriers, we like Verizon (VZ), but we’d like it more at a larger margin of safety.

Theme #3: Electric Vehicles

We forecast that one in five vehicles sold globally in 2030 will be powered by electricity, reports senior analyst Seth Goldstein. Electric vehicle, or EV, adoption will increase once EVs reach cost and functional parity with internal combustion engine, or ICE, vehicles, which we expect to happen in 2025, he maintains.

What will that entail? On the cost front, we expect EVs to become cheaper than ICEs on a total cost of ownership basis by 2025, which includes purchase price, cost of refueling (gas versus electricity), and maintenance. Indeed, we think EVs will be less costly by that time frame without subsidies, owing to cheaper batteries and greater manufacturing scale, says Goldstein. When it comes to functionality, we assume the median EV range on a single charge will exceed 300 miles, thanks to larger and more-efficient batteries. We see charge times falling, too, as chargers become more powerful, and the number of charging stations multiplying, he concludes.

We’re finding investment opportunities throughout the supply chain, including lithium producers, auto suppliers, and automakers.

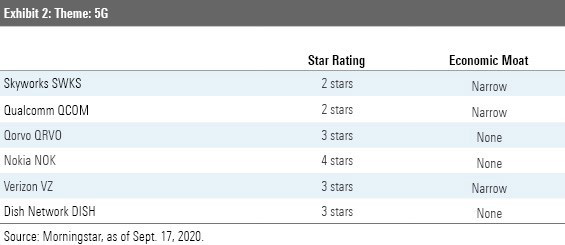

Theme #4: Renewable Energy

Renewable energy has the chance to transform the energy landscape, eventually taking the place of fossil fuels, says strategist Travis Miller. While we don’t expect renewables to completely upend fossil fuels in the next decade, we are projecting renewables to make up 22% of electricity generation by 2030, up from 7% to 8% today, he notes.

We expect a combination of corporate purchasing and state-level policies that promote renewable energy to drive growth. We think wind growth estimates are overstated and that solar will be the key disruptor.

Investors can gain exposure to renewable energy one of three ways - by investing directly in renewable energy manufacturers (such as First Solar (FSLR)), by picking up companies that invest in the infrastructure to support renewal energy (Edison International (EIX)), or by buying companies that do both (NextEra Energy (NEE)).

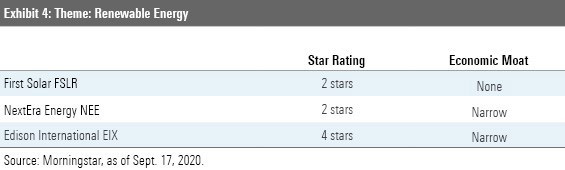

Theme #5: Big Pharma/Biotech

Several paradigm shifts are occurring that will allow Big Pharma and biotech to maintain their economic moats during the next decade, asserts strategist Karen Andersen. These companies have shifted their R&D focus away from primary care and toward niche diseases where drugmakers can maintain strong pricing for unmet demand, she says. Further, advances in immune-oncology, cell therapy, and gene therapy may transform cancer and rare-disease treatment. And thanks to the FDA’s willingness to rapidly approve innovative new drugs, drug development time is shrinking, she observes.

Nevertheless, pricing and policy remain headwinds for drugmakers. No matter who wins the White House in November, we expect some policy change, says Andersen--but we think any change will result in no more than a manageable 2% hit to industry sales. Further, we expect fewer cases going forward of new drugs being priced well above cost-effectiveness guidelines.

Overall, though, ongoing innovation in pharma and biotech should more than offset patent losses and policy headwinds.